Condo Insurance in and around Indianapolis

Indianapolis! Look no further for condo insurance

State Farm can help you with condo insurance

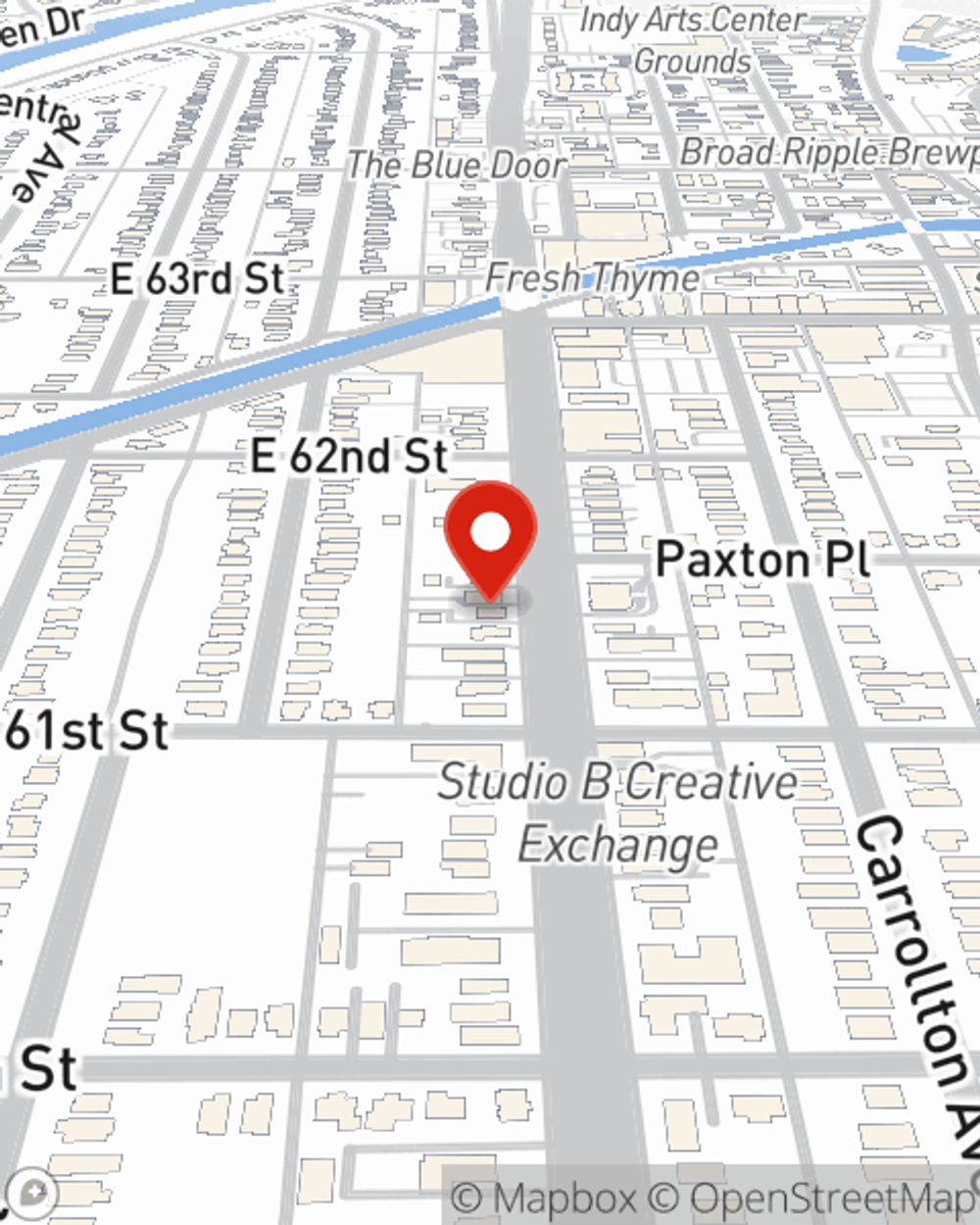

- Indianapolis

- Avon

- Broad Ripple

- Brownsburg

- Carmel

- Castleton

- Fishers

- Geist

- Greenwood

- Irvington

- Meridian Kessler

- Noblesville

- Nora

- Plainfield

- Speedway

- Westfield

- Zionsville

- Hamilton County

- Marion County

Welcome Home, Condo Owners

Investing in condo ownership is a big deal. You need to consider your future needs location and more. But once you find the perfect townhome to call home, you also need terrific insurance. Finding the right coverage can help your Indianapolis unit be a sweet place to call home!

Indianapolis! Look no further for condo insurance

State Farm can help you with condo insurance

Agent Elizabeth Marshall, At Your Service

Things do happen. Whether damage from weight of ice, theft, or other causes, State Farm has wonderful options to help you protect your condo and personal property inside against unpredictable circumstances. Agent Elizabeth Marshall would love to help you develop a policy that is personalized to your needs.

Want to learn more about the State Farm insurance options that may be right for you and your unit? Simply contact agent Elizabeth Marshall's team today!

Have More Questions About Condo Unitowners Insurance?

Call Elizabeth at (317) 255-2700 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Elizabeth Marshall

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.