Life Insurance in and around Indianapolis

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

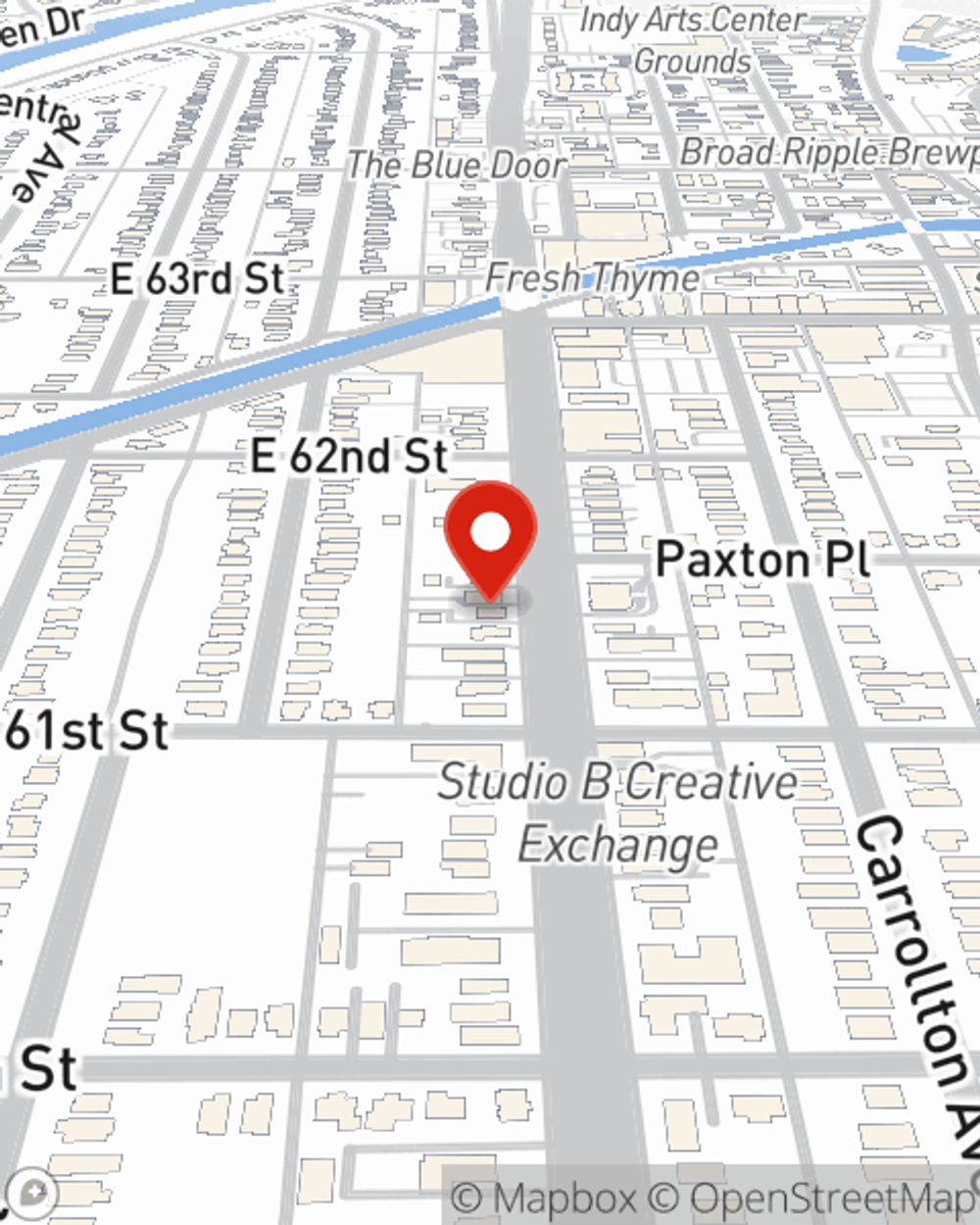

- Indianapolis

- Avon

- Broad Ripple

- Brownsburg

- Carmel

- Castleton

- Fishers

- Geist

- Greenwood

- Irvington

- Meridian Kessler

- Noblesville

- Nora

- Plainfield

- Speedway

- Westfield

- Zionsville

- Hamilton County

- Marion County

Be There For Your Loved Ones

There's a common misconception that Life insurance is only needed when you become a senior, but even if you are young and just rented your first place, now could be the right time to start looking into Life insurance.

Insurance that helps life's moments move on

What are you waiting for?

Agent Elizabeth Marshall, At Your Service

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the high costs of raising children, life insurance is a critical need for young families. Even if you're a stay-at-home parent, the costs of finding other ways to cover daycare or housekeeping can be sizeable. For those who haven't had children, you may have other family members whom you help financially or want the peace of knowing your funeral is covered.

No matter what place you're at in life, you're still a person who could need life insurance. Reach out to State Farm agent Elizabeth Marshall's office to discover the options that are right for you and your family.

Have More Questions About Life Insurance?

Call Elizabeth at (317) 255-2700 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Elizabeth Marshall

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.